IDFC FIRST Bank announces the launch of RemitFIRST2India, a next-generation digital remittance platform that allows Non-Resident Indians (NRIs) to send money to their families in India quickly, securely, and with zero transfer fees.NRI customers of IDFC FIRST Bank can simply log-in to the MobileBanking App and make the transaction. For non-IDFC FIRST Bank NRI users, the platform offers a simple, paperless onboarding journey through a dedicated web-portal.

RemitFIRST2India has been launched in partnership with SingX, a leading remittance provider licensed by Monetary Authority of Singapore, to offer a fully compliant and seamless cross-border payment experience. Currently, the platform supports transfers from Singapore and Hong Kong, with expansion plan across other countries. It also keeps the customer updatedon each step of a transaction with live transaction tracking. The platform has been designed with a strong focus on speed, transparency, and easy access.

Key Features of RemitFirst2India:

· Zero Transfer Fees: Send money without any processing or platform fees

· Competitive, Guaranteed Forex Rates: No hidden markups/charges

· Seamless Digital transfer: Speedy paperless transfer to any bank accountin India with real-time tracking

· Welcome Benefits: Enjoy extra Forexmargin on the first three transfers for new users

Speaking about this launch,Ashish Singh, Head Retail Liabilities, said, “RemitFIRST2India is more than just a remittance solution — it is a reflection of our customer-first philosophy. We’ve designed it to be intuitive, transparent, and truly global. Whether you are an existing customer or new to the Bank, you can now send money home in just a few clicks, no charges and with complete peace of mind.This launch strengthens IDFC FIRST Bank’s position as a digitally forward bank that delivers secure, efficient, and affordable banking solutions to the global Indian diaspora ”

Mr Atul Garg, Chief Executive Officer, SingX said, “With world attention centred around India, NRI flows into India are likely to double in the next 5 years. Traditionally NRIs have sent money to India for family maintenance purposes. We are increasingly seeing a number of NRIs remitting funds to India to participate in Indian debt and equity investments. We are delighted to partner with IDFC FIRST Bank to launch an innovative service which enables NRIs to transfer funds to India in a smoother and more cost-effective fashion. ”

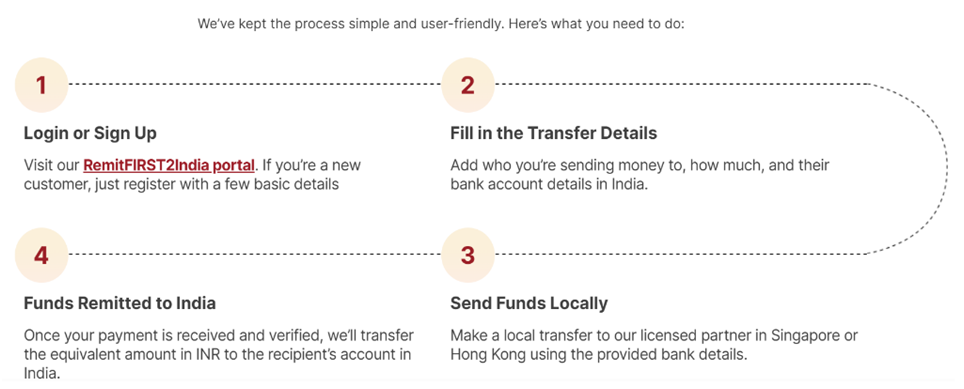

NRI Customers with IDFC FIRST Bank can send money directly using their mobile banking app without any additional registration process. New customers can also experience a frictionless process, where they can complete a quick, one-step profile creation and immediately proceed to book their transaction.

For more on How to Send Money to India details: Visit https://www.idfcfirstbank.com/nri-banking/remittance/send-money-online

India’s small business owners honored at the Grand Premiere of Muthoot FinCorp SPARK Awards

India’s small business owners honored at the Grand Premiere of Muthoot FinCorp SPARK Awards  GREW Solar Wins ‘Solar Energy Manufacturer of the Year 2025’ at the Go Global Awards

GREW Solar Wins ‘Solar Energy Manufacturer of the Year 2025’ at the Go Global Awards  India’s pharma exports nearing $30 billion, with CRDMOs and GCCs driving next phase of innovation: EY-Parthenon–OPPI report

India’s pharma exports nearing $30 billion, with CRDMOs and GCCs driving next phase of innovation: EY-Parthenon–OPPI report  360 ONE Asset appoints Pritam Doshi as CIO – Renewable Energy

360 ONE Asset appoints Pritam Doshi as CIO – Renewable Energy  APM Terminals Pipavav Strengthens Rural Healthcare with 8,000+ Eye Care Beneficiaries

APM Terminals Pipavav Strengthens Rural Healthcare with 8,000+ Eye Care Beneficiaries