- Office leasing registers 27% YoY growth to reach 7.2 mnsqft

- Residential sales above INR 20 mnachieves 57% of the market share

- Commercial rents rise 8% YoY to INR 93.5 /sq ft/month

- Sale of ultra-luxury homeover INR 500 mn surge 2,550%

- Residential prices increase 14% YoY

New Delhi, July 3, 2025: In its latest report, India Real Estate – Office and Residential Market, January to June 2025 (H1 2025), Knight Frank India has noted several major trends within the NCR real estate market. The commercial office sector continued to scale unprecedented heights whilst the residential market took a measured pause after years of sustained growth. This divergent performance reflects the region's evolving economic landscape and changing buyer preferences across both sectors.

NCR Office Market Highlights

The NCR office market has soared in H1 2025, becoming India's second-largest commercial hub after Bengaluru. Record-breaking gross leasing hit 7.2 million square feet (mnsq ft), a 27% year-on-year (YoY) surge, marking the highest leasing volume ever for the region.

This remarkable performance is driven by a perfect storm of factors that have aligned to make NCR a preferred destination for global occupiers. India's cost-effective rentals – with premium spaces still under USD 1 per square foot – combined with an exceptionally robust and scalable talent pool, continue to attract international businesses. Simultaneously, the domestic market has shown remarkable resilience, with India-facing enterprises and startups maintaining strong demand for quality office space.

NCR COMMERCIAL MARKET SUMMARY

|

Parameter |

2024 |

H1 2025 |

H1 2025 Change (YoY) |

Q2 2025 |

Q2 2025 Change (YoY) |

|

Completions in mnsq ft |

5.6 |

4.1 |

39% |

3.9 |

192% |

|

Transactions in mnsq ft |

12.7 |

7.2 |

27% |

5.2 |

98% |

|

Average transacted rent in INR/sq ft/month |

87.8 |

93.5 |

8% |

– |

– |

Source: Knight Frank Research

Gurugram Leads the Charge

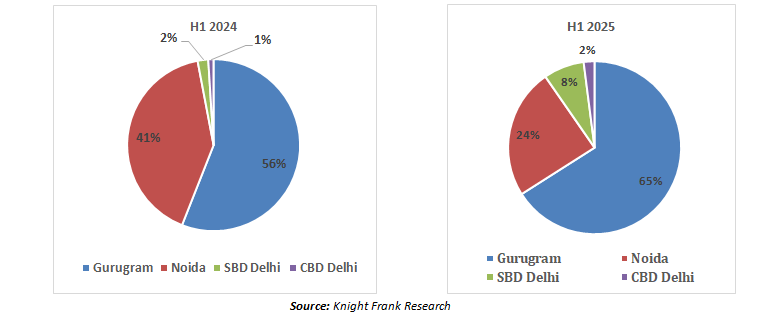

Within NCR's success story, Gurugram has emerged as the undisputed champion, commanding a dominant 65% share of total leasing activity – a striking increase of 900 basis points compared to H1 2024. This continued leadership underscores Gurugram's decade-long position as the region's most dynamic office business district. The city's diverse micro-markets, from NH-48 and Udyog Vihar to Golf Course Extension Road and DLF Cyber City, have consistently attracted occupiers across sectors.

In contrast, Noida's share declined significantly from 41% to 24%, primarily due to limited new supply, whilst both secondary business districts (SBDs) and central business districts (CBD) in Delhi witnessed modest but encouraging growth.

Business district wise transactions split in H1 2024 and H1 2025

The Rise of Global Capability Centres

Perhaps the most striking trend has been the dramatic surge in GlobalCapability Centre (GCC) activity. Their share of leasing activity rocketed from just 11% in H1 2024 to 31% in H1 2025, reflecting global enterprises' growing preference to leverage NCR's skilled talent pool for specialised functions. This shift, alongside equally strong performance from India-facing companies (also at 31%), suggests a maturing market that's attracting diverse occupier segments.

The numbers become even more impressive when considering deal sizes. The average transaction in H1 2025 reached a historic high of approximately54,000 sq ft – a substantial 43% YoY increase. This trend towards larger office footprints is likely to influence building design strategies going forward, with increased demand for larger floorplates offering higher space efficiency.

Rental Growth Reflects Strong Fundamentals

The strength of demand is clearly reflected in rental performance, with average transacted office rents recording an 8% YoY increase. This upward movement was supported by record-high leasing volumes, sustained demand, and limited availability of premium grade spaces. Interestingly, whilst new supply was introduced during the period – with completions reaching mn4.1 mnsq ft, marking a 39% YoY increase – demand for high-quality office spaces continued to outpace completions, maintaining upward pressure on rents.

The rental landscape varies considerably across business districts, with CBD Delhi commanding the highest rents at INR 220-390/sq ft/month, whilst more peripheral locations like Greater Noida offer attractive value at INR 45-55/sq ft/month.

Mudassir Zaidi, Executive Director – North, Knight Frank India said, “The NCR office market's record-breaking performance in H1 2025 reflects the city's evolution into a truly global business destination. With average deal sizes reaching 54,000 sq ft and Global Capability Centres now commanding 31% of leasing activity, we're witnessing a fundamental shift towards larger, more sophisticated occupiers who recognise NCR's unparalleled combination of cost efficiency and talent depth. This isn't just growth – it's market maturation at its finest.”

Residential Market Takes a Strategic Pause

While the office market celebrates record highs, NCR's residential sector is undergoing a strategic recalibration, not a decline. After years of sustained growth (2021-2024), H1 2025 saw a measured pause, with new unit launches declining by 17% YoY to 25,233 units.

This moderation reflects several converging factors: affordability challenges for mid-income homebuyers, shifting preferences among high-net-worth individuals (HNIs) and non-resident Indians (NRIs) towards premium and luxury housing, and the ongoing impact of infrastructure development. Sales volumes declined by 8% YoY to 26,795 units, suggesting NCR is transitioning from a speculative, investment-driven market to a more end-user-oriented one.

NCR's residential market is seeing a dramatic shift: premium and luxury housing now dominates. In H1 2025, homes over INR 20 mn made up 57% of total sales, up from 43% in H1 2024. The INR 500+mn category exploded with 2,550% YoY growth in sales, while the INR 200-500 mn bracket surged by 1,233%.

Though fewer in number, these high-value sales significantly impact the market. Ultra-luxury projects in prime Gurugram locations like Golf Course Road and Southern Peripheral Road, with some units exceeding INR 500 mn, are exceptionally well-received, often selling 60-70% immediately post-launch.

Mudassir Zaidi, Executive Director – North, Knight Frank India said, “The residential market's pivot towards premiumisation tells a fascinating story of changing aspirations. When homes above INR 20 mn capture 57% of sales and the ultra-luxury segment salesgrow by over 2,500%, what we are seeing is a significant market evolution. Buyers are increasingly prioritising quality, lifestyle, and exclusivity over speculation, which creates a more sustainable foundation for long-term growth across NCR's premium corridors.”

Gurugram Maintains Residential Dominance

Just as in the office sector, Gurugram has maintained its leadership position in residential sales, accounting for 51% of total sales and 55% of new launches in H1 2025. The city's continued dominance is supported by ongoing infrastructure upgrades along key corridors such as Dwarka Expressway, Sohna Road, and Southern Peripheral Road, which have notably enhanced overall connectivity and liveability.

Meanwhile, Noida and Greater Noida together contributed 30% of NCR's total residential sales and 29% of new launches, with Greater Noida taking the larger share due to greater land availability and infrastructure catalysts such as the upcoming Noida International Airport in Jewar.

Price Growth Reflects Market Dynamics, Infrastructure as the Great Enabler

The premiumisation trend is clearly reflected in pricing, with residential prices rising by 14% YoY in H1 2025, reaching an average of INR INR 5,535 persq ft. Key micro-markets such as South Delhi, Golf Course Road, Golf Course Extension Road, Sohna Road, and Southern Peripheral Road in Gurugram recorded the sharpest price gains due to strategic connectivity and premium positioning.

However, this price growth has not been uniform across all segments. The affordable housing segments witnessed a decline in sales, with the INR 2.5 to 5 mn range falling by 37% and the INR 5 to 7.5 mn category decreasing insales by 21% YoY. This reflects the challenges facing budget-conscious buyers, including borrowing costs, stagnant income levels, and substantial EMI burdens.

Underpinning both markets' performance is NCR's accelerated infrastructure development. Major projects such as the Delhi-Mumbai Expressway, Regional Rapid Transit System, Dwarka Expressway, and metro network expansions have significantly improved connectivity, driving interest toward emerging corridors and peripheral locations. The Noida International Airport in Jewar and planned Gurgaon Metro expansion are expected to unlock future demand, reinforcing long-term growth prospects across newly developing micro-markets.

NCR RESIDENTIAL MARKET SUMMARY

|

Parameter |

2024 |

H1 2025 |

H1 2025 Change (YoY) |

Q2 2025 |

Q2 2025 Change (YoY) |

|

Launches (housing units) |

60,699 |

25,233 |

-17% |

11,957 |

-24% |

|

Sales (housing units) |

57,654 |

26,795 |

-8% |

12,547 |

-7% |

|

Average price in INR/sq ft |

INR 5,066 |

INR 5,535 |

14% |

– |

– |

Source: Knight Frank Research

Ticket-size Segment Health in H1 2025

|

Ticket-size |

Unsold Inventory (housing units) YoY change |

Quarters-to-sell (QTS) |

|

0 – 5 mn |

32,792 (-8%) |

27.3 |

|

5 – 10 mn |

23,293 (-14%) |

10.5 |

|

10 – 20 mn |

27,882 (10%) |

6.2 |

|

20 – 50 mn |

16,354 (35%) |

3.8 |

|

50 – 100 mn |

3,544 (-20%) |

2.0 |

|

100 – 200 mn |

968 (78%) |

4.8 |

|

200 – 500 mn |

29 (-38%) |

3.7 |

|

>500 mn |

228 (3700%) |

8.6 |

Source: Knight Frank Research

A Market in Transition: NCR’s dual success story

As the focus shifts toward the second half of 2025, both residential as well as office markets appear poised for continued evolution. The office sector's momentum shows little sign of abating, with several developers having accelerated construction timelines in response to strong occupier interest. Whilst this could lead to a slight uptick in vacancy levels, they are expected to remain well within a healthy range, supported by the market's strong fundamentals.

The residential market, meanwhile, is undergoing a fundamental transformation. The shift from investment-driven speculation to end-user focused purchasing, combined with the premiumisation trend, suggests a maturing market that's becoming more sustainable in the long term. Developers are likely to maintain their strategic focus on high-end launches in line with evolving buyer preferences.

India’s small business owners honored at the Grand Premiere of Muthoot FinCorp SPARK Awards

India’s small business owners honored at the Grand Premiere of Muthoot FinCorp SPARK Awards  GREW Solar Wins ‘Solar Energy Manufacturer of the Year 2025’ at the Go Global Awards

GREW Solar Wins ‘Solar Energy Manufacturer of the Year 2025’ at the Go Global Awards  India’s pharma exports nearing $30 billion, with CRDMOs and GCCs driving next phase of innovation: EY-Parthenon–OPPI report

India’s pharma exports nearing $30 billion, with CRDMOs and GCCs driving next phase of innovation: EY-Parthenon–OPPI report  360 ONE Asset appoints Pritam Doshi as CIO – Renewable Energy

360 ONE Asset appoints Pritam Doshi as CIO – Renewable Energy  APM Terminals Pipavav Strengthens Rural Healthcare with 8,000+ Eye Care Beneficiaries

APM Terminals Pipavav Strengthens Rural Healthcare with 8,000+ Eye Care Beneficiaries